The IJMs said in their report that they had requested a statement of the company’s assets and liabilities from Hong after being appointed.

“However, to date, (Hong) has not provided this information, citing that the company’s records have been seized by CAD. Additionally, none of the company’s past and present officeholders have supplied us with such a statement,” it said.

In contrast with its available assets, the company had outstanding liabilities of S$267 million as of Aug 15, which include rental arrears of about S$409,442 for its office premises at Collyer Quay.

But the actual amount of liabilities could be higher, the IJMs noted in a circular uploaded on its website.

So far, it has received 15 proofs of debt claims from employees and trade creditors totalling about S$106,484, and records of digital asset holdings from 2,241 customers.

“NO REAL PROSPECT” OF SURVIVAL

In justifying its assessment for the company to be liquidated, the IJMs noted that the firm had “no real prospect” of survival due to several reasons.

For one, the ongoing police probe means that the firm has been “stripped of any realistic opportunity to lawfully operate or revive its core business”, even in other jurisdictions it was eyeing, such as Labuan or Abu Dhabi.

Even if it did manage to obtain regulatory approvals, its “untenable” financial position would mean insufficient assets or funds to support any restructuring, acquisition or relocation efforts, documents provided by the IJMs said.

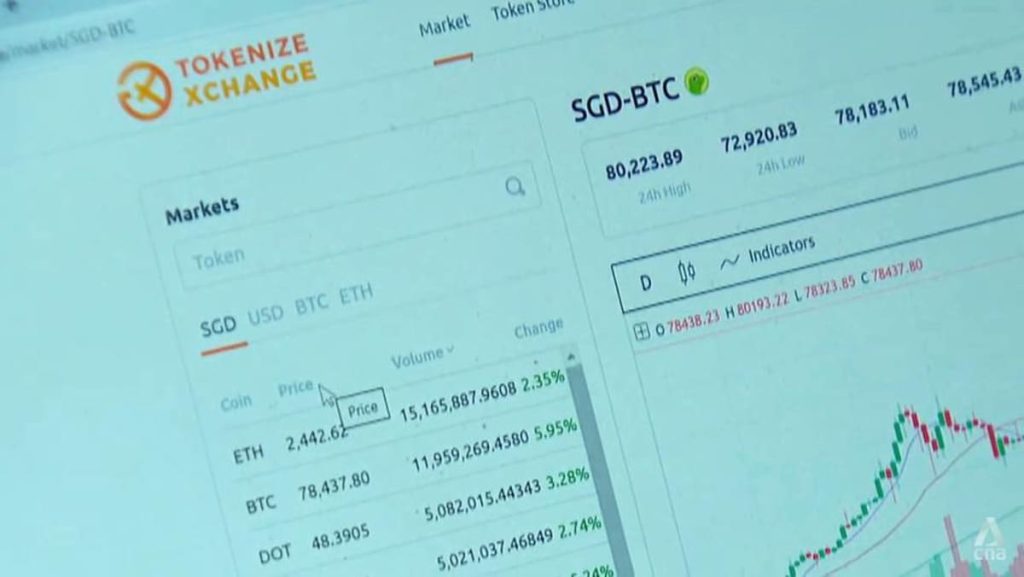

The IJMs said they have ascertained that the company’s plans to obtain licensing in Labuan, a federal territory of Malaysia, had failed after the charging of Hong, who is the chief executive and founder of Tokenize Xchange.

On the other hand, the firm’s plans to obtain licensing in the Abu Dhabi Global Market, a financial zone located in Abu Dhabi, “never developed past a preliminary stage”.

It was previously reported that in an email sent to users on Jul 8, Tokenize said it was in the “final phase” of obtaining a licence from the Abu Dhabi Global Market.