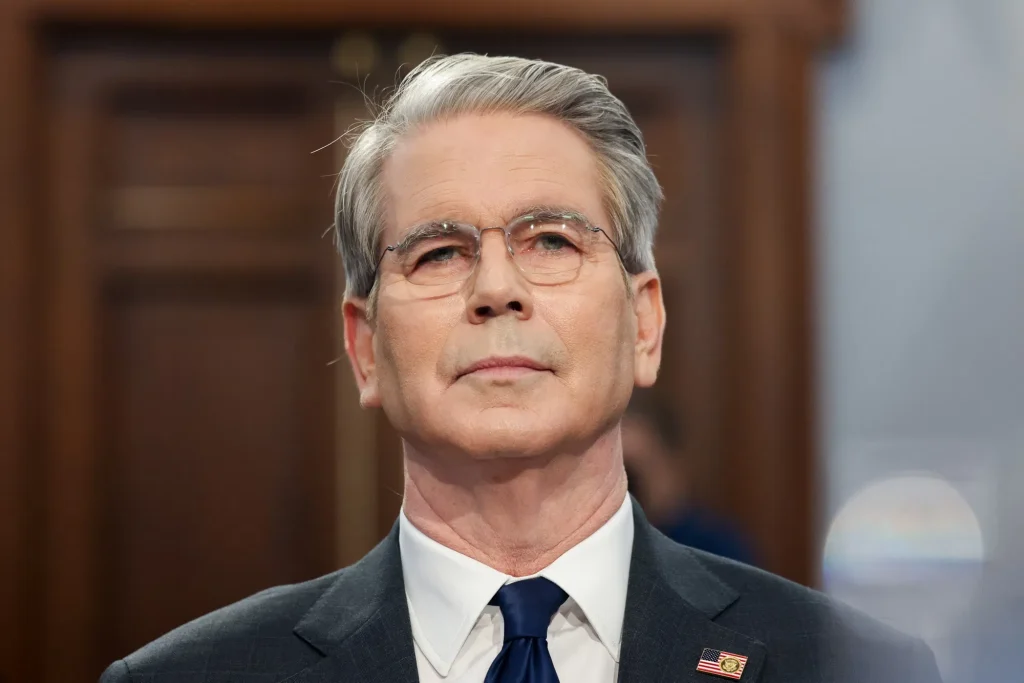

[WASHINGTON] US Treasury Secretary Scott Bessent and US Trade Representative (USTR) Jamieson Greer will travel later this week to Switzerland for trade talks with China led by Vice-Premier He Lifeng, seeking to de-escalate a tariff standoff that has threatened to hammer both economies.

The travel was announced in statements on Tuesday (May 6) from the Chinese and US governments. It will be the first confirmed trade talks between the countries since US President Donald Trump announced punishing levies of as high as 145 per cent on China that were met with retaliatory rates of 125 per cent from Beijing.

Bessent, in an interview on Fox News, said that the current tariff rates are not sustainable and were the equivalent of a trade embargo. The talks on Saturday and Sunday will centre on de-escalation rather than a big trade deal, “but we have got to de-escalate before we move forward”, he said.

“We don’t want to decouple, what we want is fair trade,” Bessent said.

The US should “show sincerity” in the talks, correct wrong practices and resolve the concerns of both sides through “equal consultation”, China’s Ministry of Commerce said in a statement after the talks were announced.

China agreed to engage with the US after an evaluation of calls from the American side and China’s own interests, the ministry said.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“If you say one thing and do another, or even attempt to continue to coerce and blackmail under the guise of talks, China will never agree, let alone sacrifice its principled position and international fairness and justice to seek any agreement,” the ministry added.

US equity-index futures rose and the US dollar strengthened on confirmation of the talks. The tariff spat has rattled markets and threatens to drive up prices for manufacturing equipment as well as affordable goods that many Americans rely on, including clothing and toys.

Bessent acknowledged that Trump’s strategy of strategic uncertainty can be unsettling for markets, though said it is an advantage for the US in talks. He said he and the president know what Trump would accept in talks, but they were not going to openly broadcast those details.

Trump has said in recent days that he is willing to lower tariffs on China at some point, but also said this week that the US is “losing nothing” by not trading with Beijing. He claimed Chinese ships are “turning around in the Pacific Ocean”.

The president has also said American consumers would be willing to accept higher prices and less selection in order to rebalance the trade relationship with China.

Young girls do not need “to have 30 dolls”, Trump said on Sunday on NBC’s Meet the Press. “I think they can have three dolls or four dolls, because what we were doing with China was just unbelievable.”

Earlier Tuesday, Bessent had said that while the US could announce trade deals with some partners as soon as this week, negotiations with China had not yet begun.

Billionaire investor Paul Tudor Jones predicted on Tuesday that Trump could slash tariffs on China in half – but warned that may not be enough to prevent markets from falling.

“You have Trump, who’s locked in on tariffs; you have the Fed, who’s locked in on not cutting rates,” said Jones, founder of macro hedge fund Tudor Investment, speaking on CNBC. “That’s not good for the stock market.”

Bessent and Greer will also meet with Swiss President Karin Keller-Sutter, the Treasury Department and USTR said in a pair of statements. BLOOMBERG