IT’S GOOD to be a US chief executive. Their pay packages are the envy of the corporate world, averaging US$16 million for the S&P 500, more than double those for the UK’s FTSE 100. And tucked inside are perks that mere mortals can only dream of.

Thanks to tough US disclosure rules, we know pet supplier Chewy gave boss Sumit Singh a US$29.3 million wad last year that included stock, cash, US$424,474 for not one but two cars and US$1,007,442 of “security services” including “meals and incidentals” for his guards.

Meanwhile, CrowdStrike CEO George Kurtz’s US$35 million package covers US$898,426 in personal jet usage and sponsorship of a professional race car that Kurtz drives in competitions.

The 2025 proxy cheerily paints this as a cost saving because it avoids “hiring a professional driver”.

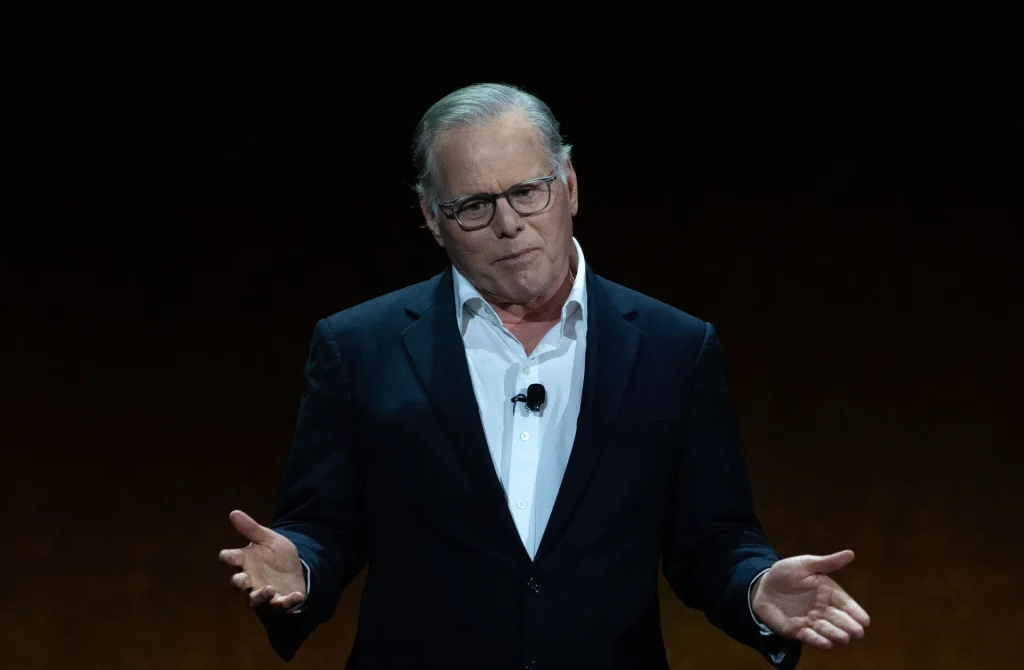

Then there’s Warner Bros Discovery (WBD). David Zaslav has been among America’s highest paid CEOs since the company was created in a 2022 merger, and last year was no exception.

He took home nearly US$52 million and the gravy train included a US$17,446 car allowance, US$991,179 in personal security, US$51,176 to cover the cost of taking personal guests to the Paris Olympics and 250 hours of personal flight time on the corporate jet worth US$813,990.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“Say on pay” vote

Neither CrowdStrike nor Chewy has held its annual “say on pay” vote yet, but Warner Bros Discovery has recently learnt there are limits to what investors will tolerate. Last week, its advisory pay vote failed, with 59 per cent of shares voting against.

The fury comes after Zaslav’s pay climbed 4.4 per cent, even as the company posted an US$11.5 billion loss for 2024 and its bond rating was recently cut to junk.

Shares are down more than 60 per cent since the merger, and it just announced plans to break itself up.

Both major proxy advisers flagged the pay package as problematic, and many investors agreed. The WBD board said it took the result “seriously” but investors in the streaming half of the business, which Zaslav will head, would do well to be wary.

The directors have a history of setting bonus targets that require little effort because they fall below what the company has already achieved.

Zaslav’s grouchy investors remain very much the exception. So far this year, 95 per cent of the S&P 500 companies that have held “say on pay” votes have won approval from at least 70 per cent of shares voted. This is a tad more than prior years, according to Conference Board/Esgauge data.

Critics of American capitalism say this shows that shareholders are too quiescent and have allowed companies to become unchecked engines of financial inequality. But the lopsided votes could also be seen as evidence that the system is doing what investors want.

Detailed disclosures and vigilant proxy advisers keep shareholders informed, down to the last dollar, and except in egregious cases, they are happy to pay up.

Now even that limited accountability is under threat.

Securities and Exchange Commission chair Paul Atkins is asking whether the current compensation disclosures are “cost-effective” and avoid “an overload of immaterial information”.

It appears to be a prelude to cutting back on the detail investors get about how bonuses are calculated and the costs of private jets and other perks.

Another commissioner, Hester Peirce, last week questioned the legality of “pass through” voting, which gives fund investors the chance to participate in “say on pay” votes, rather than being shut out of the proxy process.

Congress is seeking to rein in the influence of proxy advisers and make it harder for them to galvanise shareholders against poorly run companies.

One of them, Glass Lewis plans to encourage clients to set their own policies on pay and other proxy votes rather than rely on its recommendations.

Harder to keep track

Taken together, these moves would make it that much harder for investors both to keep track of who is getting paid what and to rebel when they think a company is overpaying or rewarding failure.

CEOs may find the proposals attractive – few relish becoming the next Marc Benioff, whose board at Salesforce redesigned his pay package and capped his private jet payments after losing a pay vote last year.

But reducing disclosure under the guise of cutting red tape carries risks. Huge payouts and perks are hard to attack if they have been fully disclosed and ratified.

Things that smack of secret self-dealing would be more vulnerable. Tyco CEO Dennis Kozlowski is a cautionary example. Leaks about lavish parties and corporate art purchases stoked outrage and led to a prison conviction for unauthorised bonuses.

Americans may be openhanded with CEO pay but they react badly if their generosity has been abused. FINANCIAL TIMES