This week in ESG: GenZero, others urge rebuilding demand for carbon credits; Mott MacDonald wins bid for nuclear feasibility assessment

Carbon markets

Carbon down but not out

If you were starving on a long road trip and chanced upon a food stand off to the side, should you stop for a bite?

What if you knew that the majority of the food at that stand was tainted and would lead to a worse outcome if eaten?

That’s kind of how carbon markets look in the world of climate action at the moment. Everyone would love to have functioning carbon markets that can help offset hard-to-abate emissions and channel capital towards decarbonisation, but it’s really difficult to get over the quality problem with carbon credits.

However, with the world still in desperate need of a way to offset emissions and to finance decarbonisation solutions, there are signs that carbon markets are gradually strengthening.

A NEWSLETTER FOR YOU

Friday, 12.30 pm

ESG Insights

An exclusive weekly report on the latest environmental, social and governance issues.

In its inaugural sustainability report, decarbonisation investment platform GenZero notes a retreat from carbon credits in the broader markets, and calls for immediate scaling of demand for credits to support the evolution of the market towards quality supply.

GenZero, which is backed by Singapore government-owned investor Temasek, is one among many within climate circles urgently working to fix carbon markets. At the heart of the movement is the belief that carbon markets are critical avenues through which financing can flow to climate solutions.

Moderate optimism

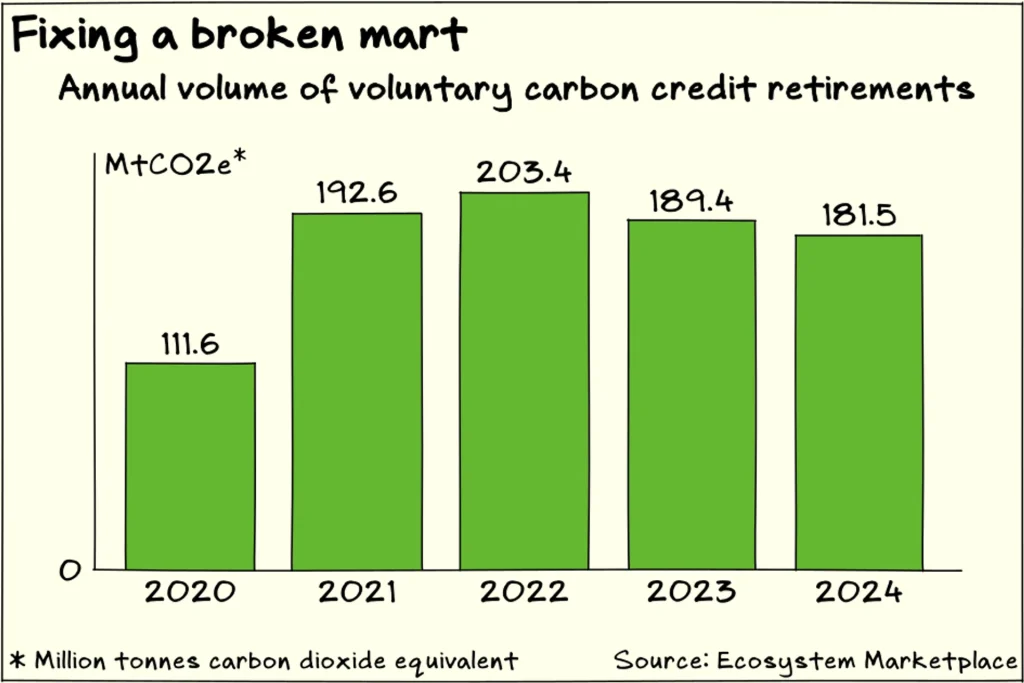

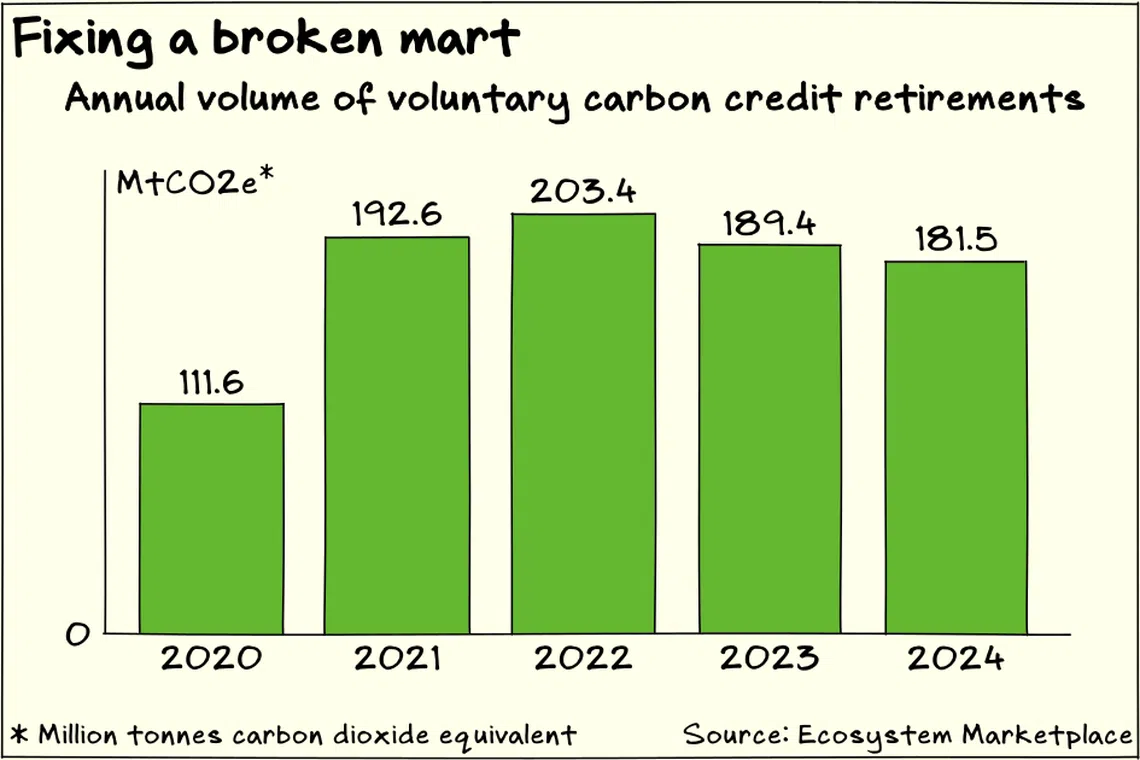

Carbon markets are currently languishing, with the total value of voluntary market transactions falling 29 per cent in 2024 to US$535 million, based on data from Ecosystem Marketplace. The average price of voluntary credits slipped 6 per cent to US$6.34 per tonne of carbon dioxide equivalent (tCO2e).

The tepid trading reflects widespread loss of confidence about the quality of carbon credits after several high-profile analyses that found a number of major projects were not removing or reducing carbon as much as claimed.

But Ecosystem Marketplace, a carbon markets information platform run by the conservation finance organisation Forest Trends, sees reasons for “moderate optimism”.

The first is that lacklustre demand is mostly directed towards poorer quality credits, typically issued under older and less rigorous standards. Prices are actually climbing for existing credits from high-quality projects, Ecosystem Marketplace says.

The second reason is that the pace of credit retirements – credits taken out of circulation because they have been used to offset emissions – has been stable over the past four years. This suggests that demand for credits from end-users remains consistent, the platform notes.

Real need

Indeed, all signs point to an increasing need for carbon credits. Even though activity in the voluntary markets has declined, the real-world need for functioning carbon markets hasn’t gone away.

The biggest new source of demand comes from international aviation, where the industry’s Carbon Offsetting and Reduction Scheme for International Aviation (Corsia) is driving decarbonisation progress. The Corsia roadmap has entered its first phase, requiring airlines from more than 120 voluntarily participating jurisdictions to purchase Corsia-eligible carbon credits by 2028 to offset their 2024-to-2026 emissions so that they don’t exceed 2019 levels.

There is currently a massive shortage of Corsia-eligible credits. Airlines may mitigate their emissions by using sustainable aviation fuel, but that is also in short supply.

Another major source of demand comes from sovereign climate goals. Europe is allowing international carbon credits to help meet its 2040 emissions targets, and some reckon that Europe could become the world’s largest sovereign buyer of international carbon credits.

Singapore, too, has been assembling a portfolio of bilateral carbon trading agreements that could allow the country’s major emitters to offset up to 5 per cent of their emissions.

On the supply side, many developing countries are banking on exporting carbon credits to help finance their decarbonisation goals. For example, Cambodia’s Nationally Determined Contributions (NDCs) under the Paris climate pact includes the development of carbon markets as one of its strategies.

Tough choices

Despite the strong need for carbon credits, the markets have been slow to commit. One reason cited for the hesitation is that the market might be valuing rigour at the expense of scale.

For example, there is currently a strong preference for credits for carbon removals – where atmospheric carbon is extracted and placed in long-term sequestration – over those for reductions – where credit is given for lowering the amount of emissions produced from a baseline rate.

That preference exists because the way that reductions are calculated leans heavily on the use of assumptions about the baseline, which exposes reduction credits to greater risk of overclaiming.

However, focusing too much on carbon removal can lead to unintended scenarios where it’s possible to sell credits from cutting down forest then replanting trees – since afforestation is carbon removal – but not from protecting the forest in the first place – since that would be carbon reduction.

Another dilemma in the market lies between nature-based removal solutions and technology-based removal solutions.

Nature-based carbon removal solutions are struggling to attract capital because they are typically not as durable as technology-based ones. For instance, planting trees might remove carbon from the atmosphere, but a forest fire could release all of the carbon back.

However, technology-based removal solutions have not been great alternatives. That’s mostly because the nascent technologies, such as direct air capture, are expensive and at small scales. They also often lack the co-benefits of nature-based solutions, which can include ecosystem conservation and economic returns for local communities.

To stretch the analogy of the roadside food stand to an unreasonable degree, nature-based solutions are like freshly cooked items at the stand while technology-based solutions are like granola bars out of a box beside the cashier at the stand. The granola bar is balanced and isn’t going to give you a stomachache, but it’s more expensive and you’ll need to wait for the next shipment before there are enough to fill you up. The cooked items are riskier, but you can get enough now, plus enjoy an experience beyond the calories.

Finding solutions

The industry is exploring different ways to rebuild trust and confidence in the carbon markets.

Ecosystem Marketplace has suggested using a portfolio approach to address the durability divide. Combining less-durable and larger-scale nature-based solutions with more robust but smaller-scale technology-based ones into portfolios could allow end users to get the best of both worlds. Nature-based credits can provide larger-scale, more immediate removals, buying time for technology-based solutions to scale up and provide longer-term carbon storage that can help to mitigate any nature-based storage that is undone.

GenZero has used an offtake-first approach to bolster its investment strategy. In a partnership with Tencent, the Chinese tech giant will offtake at least one million carbon credits from GenZero’s portfolio over 15 years.

There is also growing use of a credit-ratings approach towards carbon credits, as opposed to a commodities-based treatment. Carbon credits have historically been assessed as commodities, wherein a credit either meets a quality standard or it doesn’t. In a credit-ratings system, carbon credits are assigned a grade that reflects the quality and risk of the credit. The hope is that this improves price discovery in a market that values quality. GenZero in January invested in BeZero, a carbon credit ratings firm.

MSCI has also begun to rate carbon credits. Its analysis suggests that quality is improving in the market, with the integrity of retired credits gradually shifting towards higher grades. Newer projects also tend to have higher integrity on average.

Carbon markets may have had a rough few years, but look deep enough and there are promising signs of improvement. As Ecosystem Marketplace puts it, the voluntary carbon market is “in the middle of a transition, and transitions take time and are often messy”.

Energy transition

Updating S-E Asia’s nuclear rulebook

Singapore’s exploration of nuclear energy has taken another step forward with the appointment of Mott MacDonald to perform a feasibility study on deploying nuclear as a low-carbon energy source.

Mott MacDonald, which has more than 60 years of experience in the nuclear energy industry, beat out 23 other applicants for the contract.

Singapore’s Energy Market Authority says the country has not made any decision on whether to deploy nuclear energy, citing safety, reliability, affordability and environmental sustainability as the main considerations.

The prospect of nuclear energy in South-east Asia has been growing. Malaysia has completed a pre-feasibility study, and Science, Technology and Innovation Minister Chang Lih Kang told Parliament that initial findings suggest strong potential for nuclear to be a stable, clean and reliable power source.

Indonesia aims to commission a power plant by 2034, and the Philippines is targeting 1.2 gigawatts of nuclear energy by 2032.

Nuclear safety in South-east Asia is primarily governed by the Southeast Asia Nuclear Weapon-Free Zone Treaty, which was signed in 1995. Given the pace at which the region is moving towards nuclear energy, it might be worth reviewing the treaty to ensure that it is still relevant to a nuclear-powered region.

Other ESG reads

-

Sembcorp wins bid to build 86 MWp floating solar farm on Pandan Reservoir

-

EV maker Nio posts 0.3% wider Q2 net loss of 5.1 billion yuan despite top-line growth

-

Governments need longer-term mandates for green jet fuel to guide production: Neste CEO

-

Offshore wi

nd power projects in the Philippines cast sails in uncharted waters -

Norway says pump it up on oil and gas for now

-

‘Mockery of science’: US experts blast Trump climate report