This week in ESG: Convergence Asia-Pacific head addresses misaligned objectives; the need to do DEI right

Sustainable finance

Mismatching with South-east Asian philanthropies

There’s a line in the 1996 song Ironic by Alanis Morissette that goes, “It’s like 10,000 spoons when all you need is a knife.”

When it comes to getting philanthropies involved in blended finance in South-east Asia, it can seem like 10,000 schools when all you need is a clean-energy infrastructure project.

Blended finance is a form of development financing typically aimed at hard-to-finance needs. It uses concessional capital to mitigate risk or improve returns so that larger amounts of commercial funding can participate.

Ritesh Thakkar, Asia-Pacific head of blended finance advocacy and resources firm Convergence, says that blended finance deals in the region now tend to be infrastructure projects that support the clean-energy transition. Unfortunately, South-east Asia’s wealthy families that can provide concessional funding for these projects are more interested in generating social impact on issues such as nature-based solutions, health or education. Blended fundraising aimed at these philanthropic players have been a “big misalignment”, he says.

A NEWSLETTER FOR YOU

Friday, 12.30 pm

ESG Insights

An exclusive weekly report on the latest environmental, social and governance issues.

Thakkar sees the need to develop industry playbooks that can help philanthropies to deploy capital towards infrastructure projects for the clean-energy transition. He suggests that agricultural projects can be a place to start, because these typically also generate a positive impact on communities and improve food security.

Tapping local philanthropies has become more important in the wake of a recent pullback among developed-nation state-linked development aid sources, most notably the United States.

The good news is that the situation is probably improving. Climate change and environmental issues are gradually becoming more recognised as an important area of need among regional philanthropies in line with the broader momentum of discourse in both the public and private sectors in South-east Asia.

For example, in October 2024, the Asia Community Foundation launched the 30×30 Southeast Asia Ocean Fund, an impact fund aimed at helping to protect 30 per cent of South-east Asia’s seas by 2030. As at April, the fund had drawn 11 funders, including Bluejacket Foundation, Dalio Philanthropies, Djinda Foundation, ECCA Family Foundation, Eden Impact, Oceankind, Quantedge Advancement Initiative, Rumah Foundation and The Moh Family Foundation.

A recent study by the Bridgespan Group found that climate or the environment is considered an eligible issue area for 14 of Asia’s 20 largest philanthropies, which is more than the 12 among the 20 globally largest philanthropies. Climate and the environment are the fourth most-eligible causes – behind education, health and poverty alleviation – both globally and in Asia.

But it’s important for the blended finance community to tailor their approach to the regional characteristics of philanthropic giving.

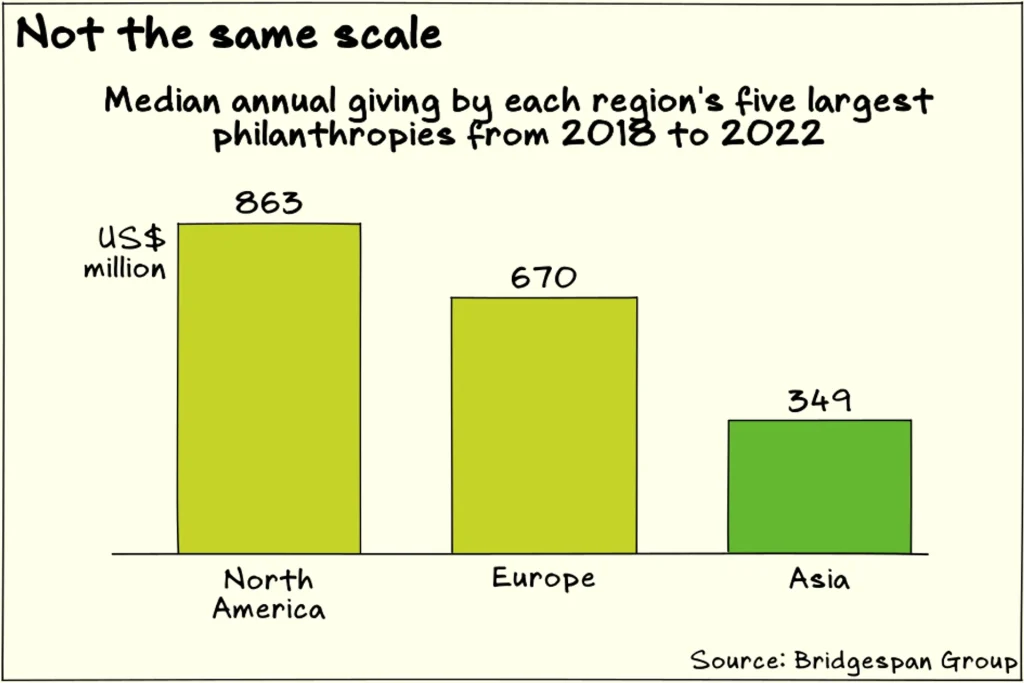

For a start, Asia’s philanthropies tend to be significantly smaller and younger than their global peers. Median annual philanthropic giving among the Asian top 20 was US$349 million between 2018 and 2022, compared with US$863 million among the North American top 20 and US$670 million among the European top 20.

Half of the 20 largest Asian institutional philanthropies were established in the past 20 years, while globally, that proportion is only 20 per cent.

Asian philanthropies also prefer to directly operate their own programmes over giving grants to non-profits. This is different from the global tendency to prefer grantmaking over their own direct services.

Programmes that pool capital, such as blended finance funds, could be useful when dealing with the smaller scale of regional philanthropies. Greater engagement with the philanthropies is also important to improve the nexus between their programmes and the region’s greatest needs.

A 2022 study by AVPN, which was previously known as the Asia Venture Philanthropy Network, highlights the value of using philanthropic funding as impactful catalytic capital, since it has the potential to align philanthropy with private wealth.

But AVPN also notes a lack of knowledge, networks and communities in Asia who are familiar with the climate field. That gap points to the need for capacity building.

Furthermore, AVPN stressed the need to have clear and committed public policy that is aligned with climate goals, since this is an important signal for philanthropies, which need to be confident that they are funding the right issues.

Turning South-east Asia’s young philanthropies into regular blended finance participants may be challenging, but the problems and recommended actions to address them don’t seem insurmountable, and the potential impact from unlocking that capital makes it worthwhile to be ambitious. To quote another Morissette song, You Learn, “I recommend biting off more than you can chew to anyone.”

Diversity, equity and inclusion

Finding the right course to stay on

Progress on diversity, equity and inclusion (DEI) does not follow a straight path, but the principles that guide its aim are pointed in the right direction.

The Republican-controlled US government has led corporate America to abandon its DEI agenda, and catalysed a rethinking across boardrooms around the world. With DEI now at a crossroads, former Singapore Institute of Directors chairman Willie Cheng argues that “the core principles of fairness, opportunity and inclusion remain essential to good governance”.

It’s an important message in these times as companies assess their diversity policies and strategies. DEI principles are sound and should remain integral to companies’ policies and culture. However, how those principles are operationalised and applied in practice might need fixing.

DEI suffers from being widely misunderstood. One of the biggest myths is that DEI is not meritocratic, a viewpoint based on two wrong assumptions: that diversity can only be achieved at the expense of merit, and that the status quo is merit-based. DEI isn’t asking companies to hire solely based on diversity goals. You shouldn’t pluck a random woman off the street, make her a director and expect to improve your board. However, DEI ensures that hiring candidates are picked from a wider pool, that the candidates are assessed free from bias, and that the assessment recognises the value of intellectual diversity, especially when expertise or perspective gaps are known and material. Approached correctly, DEI is completely consistent with meritocracy.

Another misconception is that DEI isn’t important to performance. That viewpoint is sometimes uttered to the effect of: “As a shareholder, I’m indifferent to companies’ efforts at achieving diversity. Instead, what matters to me is financial performance.”

That’s somewhat naive. When a company can tap a wider range of skills and backgrounds, it’s better able to avoid blind spots and identify potential risks and opportunities. A more equitable and inclusive culture helps to attract and retain talent. If you’re a shareholder, you should care whether directors and management are properly set up to make good decisions, and whether the company can get and keep the best staff.

Critics might also point out that academic research is inconclusive about the link between diversity and financial performance, but this isn’t surprising nor does it invalidate the value of DEI. It’s not surprising because it’s practically impossible to control for the many factors that go into making a board effective. Still, DEI is logically solid.

There’s also resistance to DEI training and education, but these widespread misconceptions about DEI are the reason why it’s important to teach boardrooms and management how to correctly approach DEI. It’s also why performative, box-ticking DEI has always been a problem; for instance, when the board sets a gender diversity target because it has to and appoints an existing director’s female friend to hit that target. It may no longer be an “old boys’ club”, but it’s still an orgy of groupthink.

DEI is a little bit like a violin. If you can figure out how to play it, you can make beautiful music. But if you don’t know what you’re doing, it sounds like a disaster.

Other ESG reads

-

Kim Heng inks deal with Singapore Energy Interconnections on submarine power projects

-

Confidence gradually being restored in carbon markets: MAS

-

Is blended finance the panacea for addressing sustainability issues in developing Asia?

-

Can digital collaboration reshape gender equity?

-

Tech giants’ indirect emissions rose 150% in 3 years as AI expands, UN agency says

-

US companies delay impact reports with DEI, ESG under attack