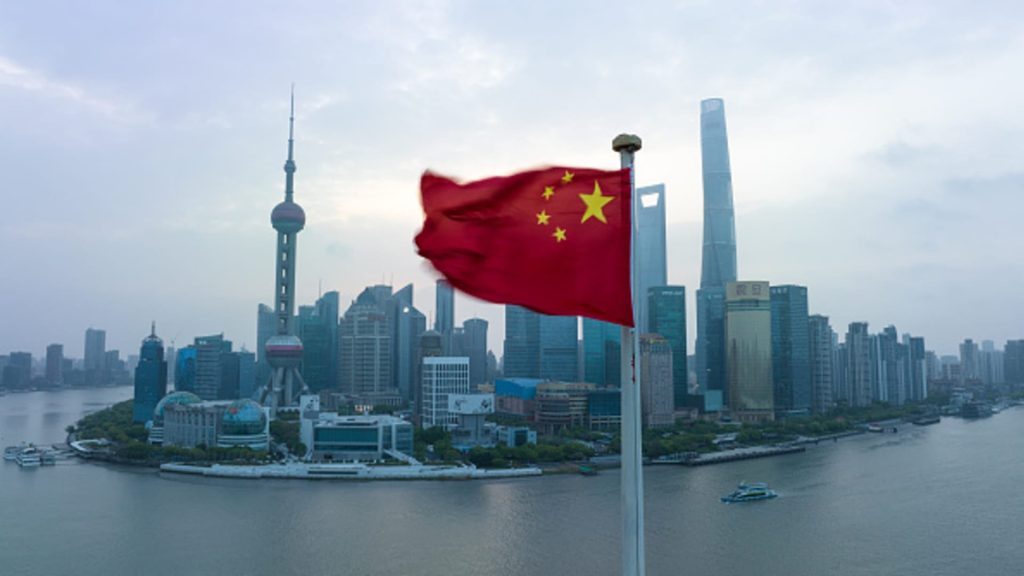

The Chinese national flag fluttering with the Lujiazui Financial District in the background.

Vcg | Visual China Group | Getty Images

Financial institutions are rethinking their China calls after a surprise trade truce between Washington and Beijing, raising both the country’s growth forecasts as well as stock market outlooks.

On Monday, the U.S. and China reached an agreement to temporarily halt the majority of tariffs on each other’s products for 90 days. Under the deal, mutual tariffs will be reduced from 125% to just 10%.

This marks a significant easing of tensions between the two countries after the tit-for-tat that ensued following U.S. President Donald Trump’s “reciprocal” tariffs on April 2, which had led to a swath of banks lowering their China growth forecasts.

Now, several institutions are revising their China outlooks.

UBS said in a note late Monday that China’s GDP growth in 2025 could climb to between 3.7% and 4%, up from a previous base case of 3.4%, given how trade war de-escalation might lead to a “smaller shock” to China’s economic growth.

Morgan Stanley has also raised to its near-term quarterly China GDP forecasts on expectations that companies may try to speed up exports to take advantage of the lower tariffs.

“While tariffs remain elevated, the suspension window could lead to front-loaded shipments and production,” the investment bank’s analysts wrote in a note. China’s second-quarter GDP could come in higher than the current estimate of 4.5%, the bank’s chief China economist Robin Xing and others wrote in the report.

Additionally, Xing and his team now expect third-quarter growth to show temporary resilience, forecasting it to be above 4%. Earlier, Morgan Stanley had said growth could soften around 4%.

ANZ Bank now sees potential for China’s GDP to come in higher than 4.2% this year, after the Australia-headquartered bank revised its forecast to 4.2% from 4.8% in April.

Similarly, Natixis sees the country’s GDP growth at 4.5% this year, up from its base case of 4.2% if there are more proactive stimulus and further reduction in tariffs. This comes after the French bank slashed its China GDP forecast to 4.2% from 4.7% in early April.

Cautious optimism

The optimism on growth prospects is improving the outlook for Chinese equities.

Nomura has raised China equities to “tactical Overweight,” and rotated some funds out of their position in India to China, it said in a note following the trade talks.

Citi has raised its target for the Hang Seng Index by 2% to 25,000 by the end of the year, and expects it to hit 26,000 by the first half of 2026.

Still, Citi’s China equity strategist Pierre Lau said he prefers domestic plays that avoid tariff uncertainties. He has upgraded the consumer sector from neutral to overweight. Lau also highlighted the country’s internet and technology sector as promising.

“We see attractive risk reward in China stocks with market valuation remaining undemanding,” said Maybank’s chief investment officer Eddy Loh, who sees opportunities in the communication services and some consumer discretionary sectors.

William Ma, chief investment officer of GROW Investment Group, who has typically been bullish on China, believes that the rebound in Chinese markets is a sustained re-rating, especially with the recent Chinese policy easing and consumption stimulus which could offer an extra boost to China’s economy and markets.

China’s CSI 300 was marginally higher Tuesday after rising 1.6% in the previous session. Hong Kong’s Hang Seng Index rose nearly 3% Monday, but was down 1.5% Tuesday.

Some experts cautioned on not getting too carried away by what may be a tactical bounce in equities.

While the U.S.-China trade talks were better than what markets had expected, the arrangement is still temporary and subject to further changes, said Loh.

This doesn’t change the bigger picture. China’s stock market still depends on domestic fundamentals, which remain weak.

The 90-day tariff reduction and break does not guarantee a deal, especially given the deterioration of mutual trust between the U.S. and China, said Natixis’ senior economist Gary Ng.

Markets rallied because the trade talk results were a surprise and not priced in, said Eurasia’s China director Dan Wang.

“This doesn’t change the bigger picture. China’s stock market still depends on domestic fundamentals, which remain weak,” she told CNBC, citing the slump in the property sector and rising local government debt which also makes the sector reliant on state-backed support.

Trump, who sees tariffs as central to his political leverage against China, may not keep tariffs low for long, Wang added.

“This is a temporary pause, not a breakthrough in the bilateral relationship. A 90-day truce is short in trade diplomacy,” she said.

—CNBC’s Evelyn Cheng contributed to this report.