|

- Fraudsters increasingly weaponize AI-powered deepfakes and synthetic identity documents to exploit the expanding digital ecosystems in APAC

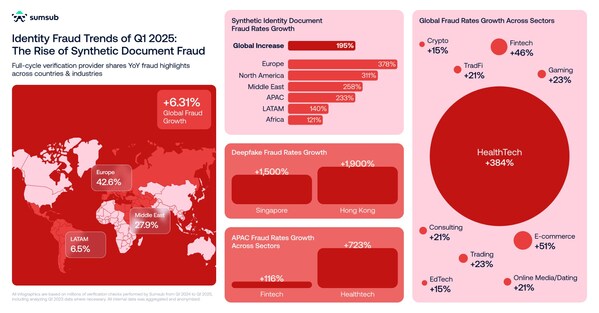

- Deepfake scams remain a persistent threat, Singapore sees a 1,500% surge; Hong Kong SAR jumps 1,900%

- Synthetic identity document fraud grows 233% in APAC, outpacing the global increase of 195%

SINGAPORE, June 12, 2025 /PRNewswire/ — As Asia Pacific’s (APAC) digital ecosystems continue to undergo explosive growth, some of the fastest-growing sectors are becoming prime targets for increasingly sophisticated fraud. New data released by global verification provider Sumsub, reveals that healthtech and fintech sectors are the most exposed to this new wave of AI-powered fraud, with healthtech recording the sharpest year-on-year spike across industries in the region—an alarming 723% compared to Q1 2024.

Sumsub, a global leader in verification, released Q1 2025 identity fraud trends based on internal data, revealing a dramatic rise in AI-enabled fraud across Asia Pacific.

In fintech, fraud remains persistent with the second highest year-on-year rise in fraud in APAC, with 116% increase over the same period. This surge in fraud comes as both sectors experience rapid growth. Fintech in APAC is set to grow from USD 450 billion in 2024, to USD 1150 billion by 2032, while digital health is expected to expand eightfold by 2033, reaching nearly USD 488.50 billion.

But as these industries scale, so does the sophistication of the fraud they face. Fueled by generative AI, synthetic identity documents, deepfakes, and AI-driven tactics are evolving rapidly—exploiting gaps in security and compliance to trick systems and commit fraud. The use of deepfakes is particularly concerning, extending beyond election interference and business impersonation to AI-generated job scams. Singapore recorded a staggering 1,500% surge in deepfake fraud cases from 2024 while Hong Kong SAR saw an even more dramatic 1,900% jump.

As AI becomes more accessible, fraudsters are using AI-powered tools to construct synthetic identity documents, combining real data like a valid ID number with fictitious details to create a completely new, non-existent persona. In sectors like fintech and healthtech, where digital onboarding and remote verification are common, these AI-generated documents are often used to impersonate legitimate users during Know Your Customer (KYC) checks. This allows bad actors to fraudulently access financial services or sensitive health records, posing serious risks to both service providers and end users.

Globally, synthetic identity document fraud cases have surged by 195%, with APAC seeing an even sharper rise of 233%, underscoring the scale and sophistication of the threat. Several APAC markets have recorded a sharp year-on-year rise in synthetic identity document fraud (Q1 2024 to Q1 2025), with particularly steep increases in:

- Philippines: 291% increase

- Hong Kong SAR: 209% increase

- Thailand: 188% increase

- Singapore: 184% increase

- Australia: 117% increase

“While fintech fraud is a familiar battleground, given the sector’s long standing exposure to financial crime and its evolution alongside crypto, the scale of fraud in healthtech signals a worrying new frontier. As more healthcare services go digital, the sector’s vulnerabilities are being exploited at pace, putting trust in the digital health system at serious risk. The surges in AI-powered fraud, including deepfakes and synthetic identity documents, is exposing critical flaws in traditional verification systems,” said Penny Chai, Vice President, APAC, Sumsub. “To protect themselves, businesses must move beyond outdated approaches and adopt multi-layered, adaptive defenses. At Sumsub, our focus is on helping businesses stay one step ahead of fraudsters by anticipating new attack vectors and delivering smarter, more resilient full-cycle verification solution.”

In response to the rapidly growing fraud risks in the region and across the globe, Sumsub will host its inaugural What The Fraud Summit to serve as a dedicated platform for industry leaders, regulators and fraud experts to have bold conversations and exchange actionable insights to beat the global fraudemic. The Summit will be held in Singapore from November 19 to 20, 2025.

Learn more about the WTF Summit and ticket details: https://sumsub.com/wtf-summit/

About Sumsub

Sumsub is a full-cycle verification platform that secures the whole user journey. With Sumsub’s customizable KYC, KYB, Transaction Monitoring, and Fraud Prevention solutions, you can orchestrate your verification process, welcome more customers worldwide, meet compliance requirements, reduce costs, and protect your business.

Sumsub has over 4,000 clients across the fintech, crypto, transportation, trading, e-commerce, education, and gaming industries, including Bitpanda, Wirex, Avis, Bybit, Vodafone, Duolingo, Kaizen Gaming, and TransferGo.

Sumsub has citations in research published by global institutions such as the United Nations and Statista, as well as ongoing consultancy and engagements with INTERPOL.