Businesses across the United States have for months warned that they would raise prices on their customers in response to President Trump’s tariffs.

The latest data show that it is happening only in a limited way so far, helping to keep a lid on inflation.

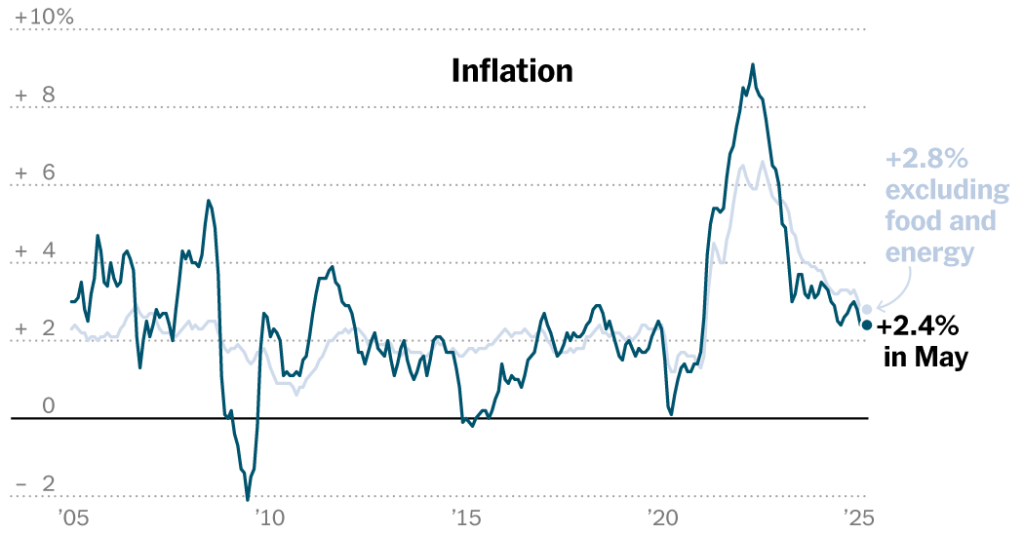

The Consumer Price Index, released on Wednesday, rose 2.4 percent in May from a year earlier, just above April’s 2.3 percent annual increase.

“Core” inflation steadied at 2.8 percent. That measure, which strips out volatile food and energy products, is closely monitored by policymakers as a gauge for underlying price pressures.

On a monthly basis, the overall measure rose 0.1 percent, in line with the core index. Both were below economists’ expectations.

The latest data, released by the Bureau of Labor Statistics, reflects a mixed picture about the economic impact of Mr. Trump’s tariffs — the scope and scale of which have changed repeatedly since the president launched his global trade war. Tariffs are a tax on imports, and economists expect the effect on prices to become more pronounced over the summer as more businesses pass along higher costs to consumers, as many have said they will do.

Most of the businesses surveyed in May by the Federal Reserve Bank of New York said they had passed on at least some of the tariffs to their customers. Nearly half of the service-oriented companies passed along all of those higher costs by raising their prices, whereas one-third of manufacturers responding to the survey did the same.

A similar phenomenon is taking place across the country. The latest Beige Book, which compiles economic anecdotes from the 12 regional banks across the Federal Reserve System, noted that there were “widespread reports of contacts expecting costs and prices to rise at a faster rate going forward.” Those that expected to pass along higher costs planned to do so “within three months,” the report said.

But the data so far shows that isn’t happening in a significant enough way to bid up inflation overall. In categories expected to be most exposed to tariffs, like furniture, prices were down 0.8 percent in May. That is the weakest reading since December. Clothing costs fell 0.4 percent, while prices for both new and used cars also declined.

A drop in airline fares and energy prices also helped to offset an increase in housing-related costs and those related to dining out.

One explanation is that businesses had stockpiled inventories ahead of Mr. Trump’s levies and able to lock in lower prices as a result.

Tariffs are still the biggest wild card for the central bank’s outlook for inflation, growth and the labor market for this year. Heading into Mr. Trump’s second term in the White House, inflation appeared on track to return to the Fed’s longstanding 2 percent target after years of running well above that level in the aftermath of the pandemic.

The Fed is now grappling with how significantly Mr. Trump’s policies, which also include curbing immigration, cutting taxes and slashing government spending, will raise prices for Americans, and for how long any resulting period of higher inflation will last as growth slows.

In minutes from the Fed’s last meeting in May, the central bank’s staff penciled in a forecast that carries the whiff of stagflation. They said a recession was “almost as likely” as its forecast for subdued growth and higher unemployment. Tariffs, they said, were expected to boost inflation “markedly this year” and continue to add price pressures in 2026 before inflation trended back to the 2 percent target by 2027.

Officials are most worried that tariffs could ignite a sustained period of price increases rather than a one-off jump. The risk is that Americans start to expect higher inflation over the long term to a degree that ends up becoming self-fulfilling. Such persistent inflation would hamstring the Fed’s ability to support the economy — by lowering interest rates — if growth slows and the labor market weakens.

For now, the labor market is cooling, but it has not yet cracked. That has reinforced the Fed’s view that it can take its time before making any big decisions about interest rates. After lowering borrowing costs by a percentage point last year, the central bank has kept interest rates steady since January, at a range of 4.25 percent to 4.5 percent.

Fed officials are widely expected to extend that pause when they gather next Tuesday and Wednesday and maintain the view that they can afford to be patient on cuts. With inflation risks still elevated, the central bank has made clear that before lowering interest rates again, it will need to see clearer signs that the labor market is deteriorating.

Government bond yields fell on Wednesday, a sign that investors see inflation as less of an obstacle to the Fed lowering interest rates. The 10-year Treasury yield dropped almost 0.1 percentage points, a large move in that market, to just above 4.4 percent.

Joe Rennison contributed reporting.