[HONG KONG] Stocks started limply on Wednesday as investors struggled to match Wall Street’s rally, with data showing Chinese factory activity contracted this month at its fastest pace for nearly two years as Donald Trump’s trade war kicked in.

While markets have recovered some of the losses suffered after the US president’s “Liberation Day” tariffs announcement on April 2, uncertainty still rules as countries look to cut deals to avert the worst of Washington’s ire.

China has pointedly not flown to the United States in a bid to pare back the levies of up to 145 per cent imposed on its goods, instead hitting back with 125 per cent tolls of its own.

But the effect of the measures began to shine through in April, with data on Wednesday showing manufacturing activity contracted at its fastest pace since July 2023 – a month after expanding at its quickest rate for 12 months.

That came after Chinese exports soared more than 12 per cent last month as businesses rushed to get ahead of the tariffs.

And observers fear things will only worsen.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

“The weak manufacturing PMI in April is driven by the trade war,” Zhiwei Zhang, president and chief economist at Pinpoint Asset Management, wrote in a note.

“The macro data in China and the US will weaken further… as the trade policy uncertainty delays business decisions,” he added.

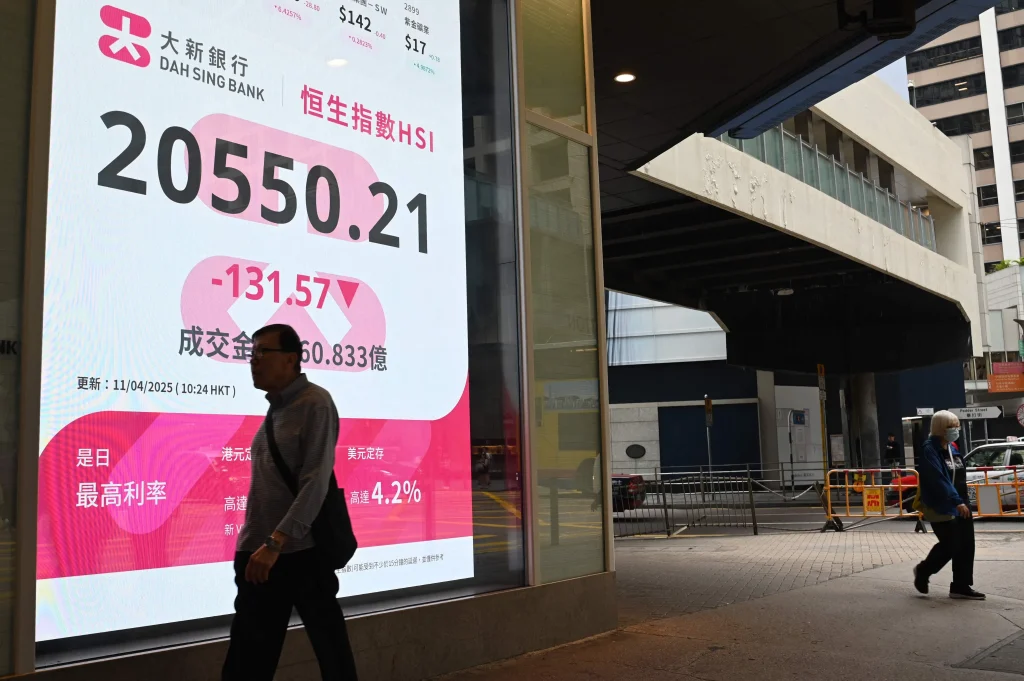

Shares fell in Hong Kong and Shanghai, while they were also off in Seoul, Wellington and Jakarta.

Tokyo rose thanks to a surge in Sony fuelled by a report that it is considering spinning off its chip unit, raising expectations that such a move would unlock value in the Japanese entertainment and electronics company.

Sydney, Singapore, Taipei and Manila also edged up.

Equities have clawed back a lot of the huge losses suffered at the start of the month as Trump has shown a little more flexibility on some issues and as governments hold talks with Washington.

US Commerce Secretary Howard Lutnick said he had reached a deal with a country but did not name it, while Treasury Secretary Scott Bessent said progress had been made with India, South Korea and Japan.

But Saxo chief investment strategist Charu Chanana warned economic data will likely worsen.

“We’ve probably seen peak tariff rates, but not peak tariff uncertainty,” she said in a commentary.

“The hard data still reflects the impact of front-loaded demand, as companies and consumers rushed to buy goods ahead of expected tariff increases.

“We haven’t yet seen the real data showing the drag from sustained uncertainty and elevated tariff costs. As that uncertainty filters through business decisions, we expect a more meaningful slowdown in real economic activity – in production, hiring, and investment.

“In short, the rate shock may be behind us, but the real growth damage is just starting to unfold.”

Investors are awaiting the release of key US inflation and economic growth data due later in the day, while jobs figures are lined up for Friday.

This week also sees the release of earnings from Wall Street titans including Microsoft, Apple, Meta and Amazon, which observers hope will provide an insight into how corporate America is dealing with the tariffs crisis, and how they expect to fare. AFP