[SINGAPORE] It is midway into the earnings season for Singapore-listed real estate investment trusts (S-Reits), with most of them having posted their first-quarter results.

Closely watched among investors and analysts is the impact that US tariffs will have on these S-Reits. They are also looking out for the Reit managers’ plans to counteract the effect of the tariffs imposed by US President Donald Trump.

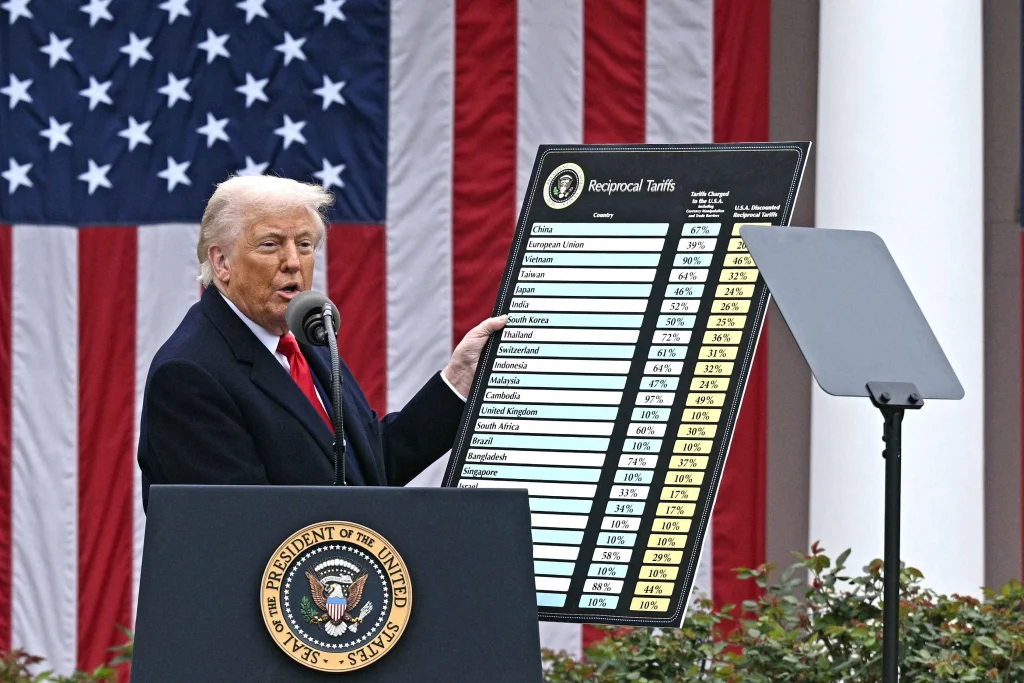

The “Liberation Day” tariffs announced on Apr 2 sparked a sell-off of S-Reits that week, although the sector has since rebounded. As at Wednesday’s (Apr 30) close, the iEdge S-Reit index had climbed 8.7 per cent since Apr 9, when the tariffs took effect.

Given the broad scope and global reach of the proposed tariffs, their long-term economic impact could be significant, especially if Trump proceeds with implementation.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

For S-Reits, which are only now seeing a performance rebound amid easing interest rates, failing to address these risks in a meaningful way could undermine recent gains.

Scant details

A total of 14 S-Reits had posted their Q1 results as of Apr 30. Many gave a brief overview on how they would be affected by the tariffs.

In general, they seemed to feel that an economic slowdown would lead to tenants pulling back or hesitating on lease commitments. For instance, the manager of Mapletree Pan Asia Commercial Trust noted in its recent fourth-quarter results that tenants had become more cost-conscious, and decision-making among them had “slowed down quite a lot”.

Others, such as CapitaLand Ascott Trust, offered more details. Its Q1 business update disclosed that while the Reit might take a hit to the demand for lodging, its diverse mix of guests and longer-stay accommodation type would go some way to blunt the impact.

Several Reit managers also said they would adopt a wait-and-see approach, given that the tariffs were announced a month ago, and there have been constant changes to their scope.

The chief executive officer of Suntec Reit’s manager, for example, said at a briefing on Suntec Reit’s Q1 results that the Reit manager was watching for trends in retail tenant sales, with the tariffs having been implemented only in April.

However, overall, S-Reit managers have so far offered few details on how the tariffs would hit their portfolios, and how they intend to address the fallout. These include specific details on the extent to which a Reits’ assets may be affected, or how exactly the manager will mitigate the impact of the tariffs.

For instance, Keppel Reit’s business update for Q1 focused on its performance, but offered little by way of how the economic situation could affect its outlook.

Far East Hospitality Trust’s business update presentation for Q1 acknowledged that trade tensions could cloud economic outlook, but added that the outlook for tourism remained positive, with more visitors returning to Singapore post-pandemic, wooed by new attractions.

Details – such as the extent to which a recovery in visitor arrivals would offset the negative economic outlook, or how the trust intends to respond to tourists spending less – would give investors a better understanding of the trust’s strategy during this period.

Granted, most S-Reits provide only business updates for their Q1 financial results. These are typically released as announcements on the Singapore Exchange, and do not give Reit managers much scope to share their outlook.

Furthermore, not all Reits hold briefings for analysts or the media. Such platforms would otherwise provide an avenue for market watchers to probe Reit managers further on their strategies.

Nevertheless, given how quickly the market moves in response to Trump’s policy pronouncements – which the US president has changed several times now – it is imperative that S-Reits keep investors informed of their game plan should the worst happen.

What managers can do

S-Reit managers can afford to provide more detail on their response to Trump’s tariffs. Beyond acknowledging the tariffs’ impact, they can explain the extent to which the tariffs will affect their bottom lines.

They can also give more details on the specific assets or geographies which will be hit by the tariffs, and lay out scenarios based on the severity of the tariffs.

Rather than say that they will adopt a “wait-and-see approach”, managers should go a step further to share active plans they may have to mitigate the impact of tariffs. This could be anything ranging from incentives to encourage tenants to commit to leases quickly, or more extreme measures like divesting of assets or rejigging their portfolio mix by subsectors or geographies.

While their Q1 business updates may not be the best platform to share these plans, Reit managers can look for alternative platforms, such as upcoming annual general meetings or Singapore Exchange announcements, to do so.

Such moves would quell investor concerns during a turbulent economic period and instill confidence in the Reit management.

There is still some way to go until the end of the current earnings season. With S-Reit performances expected to see an uptick overall due to lower interest rates, it would do them good to keep the positive momentum going.