Jul 1

2025

MDaudit and Streamline Health Announce Definitive Merger Agreement

MDaudit, a portfolio company of Bregal Sagemount & Primus Capital and an award-winning cloud-based continuous risk monitoring platform that enables the nation’s premier healthcare organizations to minimize billing risks and maximize revenues, and Streamline Health Solutions, Inc., a leading provider of solutions that enable healthcare providers to improve financial performance, announced today that they have entered into a definitive merger agreement pursuant to which MDaudit will acquire Streamline.

This combination brings together two organizations that share a common vision: enabling healthcare organizations to expand patient care and access by improving financial stability. By joining Streamline’s pre-bill integrity solutions with MDaudit’s robust billing compliance and revenue integrity platform, the parties believe that the combined organization will be uniquely positioned to unify disparate data silos, broaden executive insights, and drive coordinated actions across the revenue cycle continuum to accelerate revenue outcomes and mitigate risk.

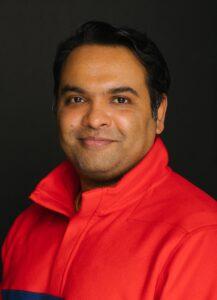

“At a time when health systems are facing mounting financial and operational pressures, we believe the future belongs to those who can connect the dots across the revenue cycle continuum with data- and AI-driven solutions,” said Ritesh Ramesh, CEO of MDaudit. “Streamline’s RevID and eValuator solutions complement MDaudit’s current strengths in billing compliance and revenue integrity capabilities by enabling pre-bill visibility in real-time to unlock revenue opportunities. These solutions reflect our shared belief that human-driven revenue cycles deserve proactive, systemwide intelligence with closed feedback loops that are actionable”.

“MDaudit and Streamline have always believed that the most sophisticated technology won’t drive successful outcomes without an unwavering focus on customer satisfaction,” said Ben Stilwill, CEO of Streamline Health. “Our teams have built trust by being true partners to our customers. Together, we’re building a broader platform that reflects the reality of today’s revenue cycle: distributed teams, disconnected data, and immense responsibility. Together, we’re delivering foresight and action; not just reports or alerts.”

Transaction Summary

At the effective time of the merger, a wholly-owned subsidiary of MDaudit will merge with and into Streamline, with Streamline surviving the merger as a wholly-owned subsidiary of MDaudit. The closing of the transaction is subject to certain customary closing conditions, including approval of the merger agreement by the Streamline stockholders. The transaction is not subject to a financing condition, and MDaudit intends to finance the transaction using a combination of cash on hand and available funds from existing credit facilities.

The merger is expected to close during the third quarter of 2025. Following the closing of the merger, Streamline’s common stock will no longer be listed on the Nasdaq Stock Market, and Streamline will become a private company.