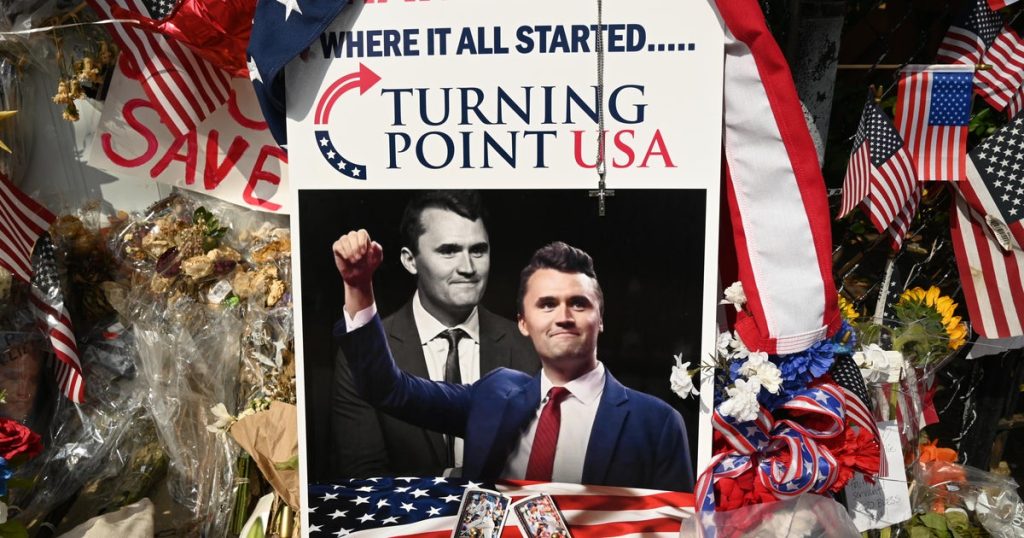

Northrop Auditorium at the University of Minnesota in Minneapolis was packed on Monday night as Turning Point USA hosted its first event since Charlie Kirk’s memorial service.

He was killed on Sept. 10 during an event at Utah Valley University. He had been at the school for the organization he started, Turning Point USA, a nonprofit that advocates on college campuses for conservative causes.

Before Charlie Kirk died, that group had scheduled an event at the University of Minnesota. In the wake of his death, the American Comeback Tour, put on by Turning Point USA, continued as planned.

The event was hosted by conservative commentator and author Michael Knowles. He took time to speak about the man Charlie Kirk was and the fight he had in him, and asked supporters to honor him by turning to their faith. Several students WCCO spoke to said that was the message they wanted to hear.

“Charlie Kirk, even though at times, he could be bitey with his answers, he was very solid in what he had to say, and I just really admired that, of how firm he was, and unwavering in his faith,” said student Lucy Pink.

Barriers and metal detectors were set up outside the auditorium, preparing to welcome students and community leaders.

WCCO

Monday’s event also drew around 100 protesters to the university. One person said the visit made her worried about the safety of some students.

The tour’s next scheduled stop is Virginia.

“I didn’t know him personally, but I’ve been watching him for 10 years, so it definitely hit,” said Rylan Krull, from Jordan, ahead of the event.

“I really admired the fact that he could speak up about his faith boldly, regardless of the hate they got,” said Mary Tambach.

“His views are pretty polar to mine, but I don’t think anyone should get shot for their views,” said sophomore Chris Cox.

Thousands showed up for Sunday’s memorial service for the conservative activist. Included in the long list of speakers were President Trump, Vice President JD Vance and Charlie Kirk’s widow, Erika.

Following her husband’s assassination, Erika Kirk was named the CEO of Turning Point USA. At the memorial, she vowed the organization’s events and campus debates would continue.

“Charlie and I were united in purpose. His passion was my passion. And now his mission is my mission,” Erika Kirk said. “Everything we will make 10 times greater through the power of his memory.”

Charlie Kirk frequently drew controversy for his views. He supported Mr. Trump’s false claims of voter fraud after the 2020 election, and his group maintained a “Professor Watchlist” of college instructors accused of spreading “leftist propaganda.”

He espoused anti-trans rhetoric and amplified the “Great Replacement” conspiracy, the claim that there’s a plot to replace White people with minorities.

Joe Walsh and

Beret Leone

contributed to this report.