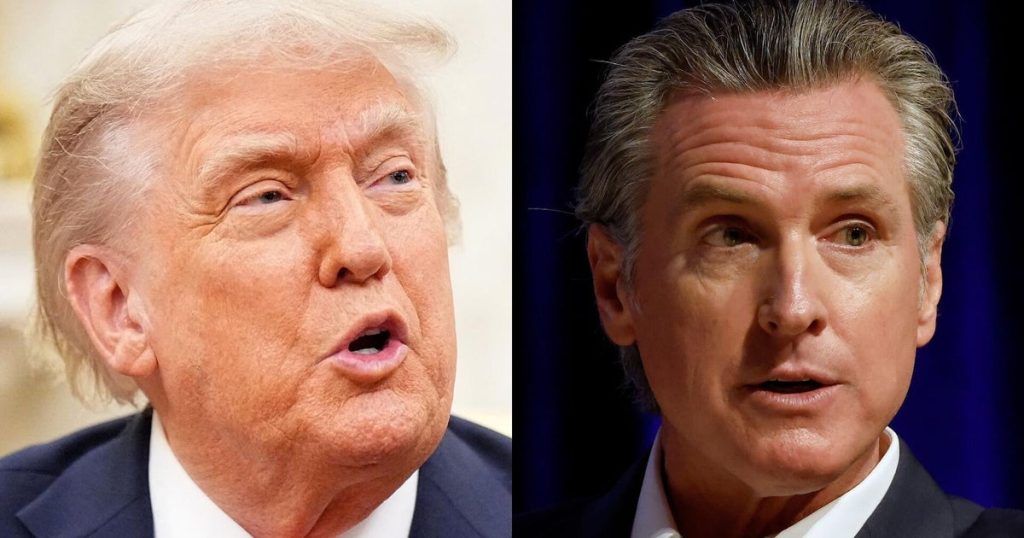

As tensions escalate between California and the Trump administration over immigration, another potential battlefront is emerging over taxes.

The spat began with reports that the Trump administration is considering cutting funding for California’s university system, the largest higher education system in the nation with about 12% of all U.S. enrolled students. In response, Gov. Gavin Newsom wrote Friday afternoon in a social media post that California provides about $80 billion more in taxes to the federal government than it receives in return.

“Maybe it’s time to cut that off, @realDonaldTrump,” Newsom said.

What is a donor state?

A donor state is one that provides more in taxes to the federal government than they receive in return. The largest one, by far, is California, according to tax data.

In 2022, California’s residents and businesses provided $692 billion in tax revenue to the federal government. In return, the state received $609 billion in federal funding, leaving a gap of about $83 billion, according to the California Budget and Policy Center, a nonpartisan think tank.

See which states are the biggest donors

California’s gap is so large partly due to the large number of high-income residents in the state, who pay a larger share of their income toward federal taxes than lower-income workers, the California Budget and Policy Center says.

Overall, 11 U.S. states contribute more in taxes to the federal government than they get back, according to the Rockefeller Institute of Government:

- California ($83 billion gap)

- New Jersey ($28.9 billion)

- Massachusetts ($27 billion)

- Washington state ($17.8 billion)

- New York ($7.1 billion)

- Minnesota ($4.5 billion)

- Colorada ($2.9 billion)

- Illinois ($2.6 billion)

- New Hampshire ($2.4 billion)

- Connecticut ($1.9 billion)

- Utah ($709 million)

Other states receive more in funding than they provide to the federal government, according to the tax data. The imbalance stems from a mix of reasons, ranging from some states having a larger share of residents on federal aid programs, such as Medicaid, to a larger number of federal facilities, such as military bases, compared with other states, according to the California Budget and Policy Center.

What has the Trump administration said?

In response to Newsom’s post about boycotting federal tax payments, Treasury Secretary Scott Bessent warned in a Sunday social media post that the governor “is threatening to commit criminal tax evasion.”

“His plan: defraud the American taxpayer and leave California residents on the hook for unpaid federal taxes,” Bessent wrote.

Bessent added, “Instead of committing criminal tax evasion, Governor Newsom should consider a tax plan for California that follows the Trump Tax Cuts model and reduces the onerous state tax burden to allow families to keep more of their hard-earned money.”