[HONG KONG] Asian equities rose on Wednesday following a Wall Street rally as traders cheered forecast-beating US consumer confidence data and a drop in bond yields, with eyes now on a key sale of Japanese debt.

New York investors returned to their desks after a long weekend break in a good mood after Donald Trump delayed until July the 50 per cent tariffs he announced out of the blue on Friday, sparking a market rout.

The US president’s announcement Sunday soothed worries about a fresh flare-up in his trade war that has rattled global sentiment, fanned uncertainty and led some to question their confidence in the world’s biggest economy.

Buying was also boosted by Trump’s post on social media saying progress with Brussels was being made.

“I have just been informed that the EU has called to quickly establish meeting dates,” he said on his Truth Social platform.

“This is a positive event, and I hope that they will, FINALLY, like my same demand to China, open up the European Nations for Trade with the United States of America.”

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Markets also cheered data showing a bigger-than-expected jump in US consumer confidence thanks to a slight easing of trade tensions, particularly with China.

The lift in the Conference Board’s index was the first improvement after five months of decline and dragged it up from lows last seen at the onset of the Covid-19 pandemic. However, the report did warn that tariffs remained a key concern.

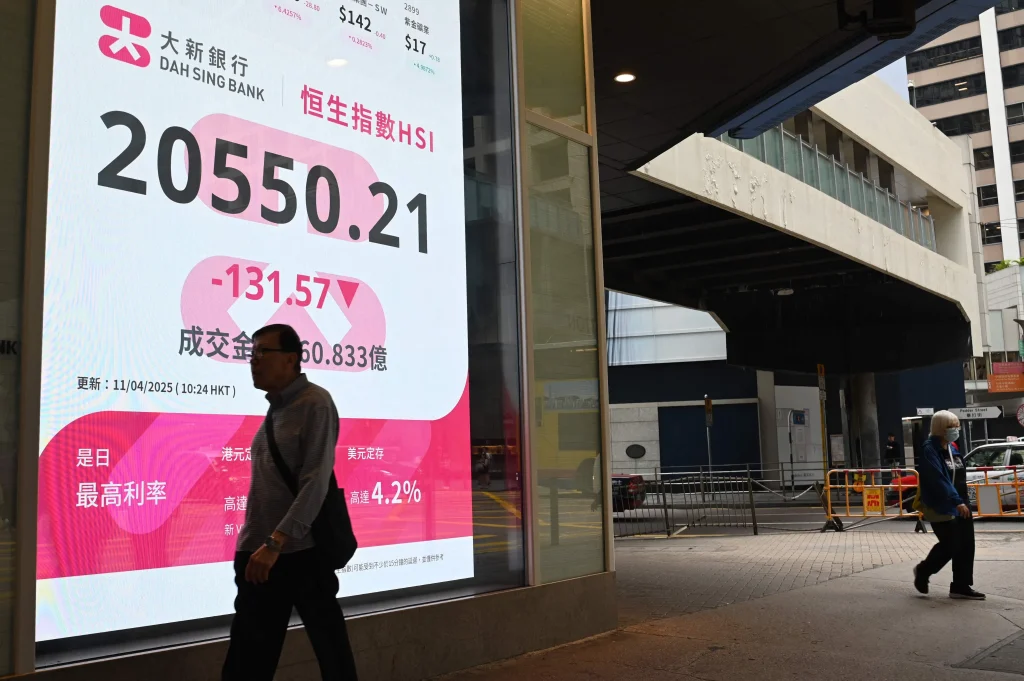

Hong Kong, Shanghai, Sydney, Seoul, Singapore, Taipei, Manila and Jakarta all rose. Wellington was in the red even after New Zealand’s central bank cut interest rates for the sixth meeting in a row.

Tokyo was also on the front foot as investors eye the crucial sale of Japanese 40-year government bonds, after an auction of 20-year notes this month saw the worst take-up in more than a decade.

The cost of government debt has surged around the world in recent weeks – hitting record highs last week in Japan – amid worries about rising spending as leaders try to support their economies and after Trump’s April 2 tariff blitz.

However, yields tumbled on Tuesday after Japan’s Ministry of Finance sent a questionnaire to market players regarding issuance, fuelling talk that it was considering slowing its sales down, meaning there would be less supply.

Masahiko Loo, senior fixed income strategist at State Street Global Advisors, said the recent panic over the Japanese government bond (JGB) market may have been overdone.

“We maintain our long-standing view that the challenges in the JGB market are technical rather than structural. These issues are largely addressable through adjustments in issuance volume or composition,” he wrote in a commentary.

“We believe the concern on loss of control over the super-long end is overblown. Around 90 per cent of JGBs are domestically held, and the ‘don’t fight the BOJ/MOF’ mantra remains a powerful anchor,” he added, referring to the Bank of Japan and Ministry of Finance.

“Any perceived supply-demand imbalance is more a matter of timing mismatches, which is a technical dislocation rather than a fundamental flaw.

“We expect these imbalances to be resolved as early as the third quarter of 2025. The MOF potential reduction headline reinforces our view.”

The drop in Japanese yields sent the yen lower on Tuesday, and it held those losses in early trade Wednesday, sitting around 144.30 per dollar. AFP