Published Thu, May 8, 2025 · 09:30 AM

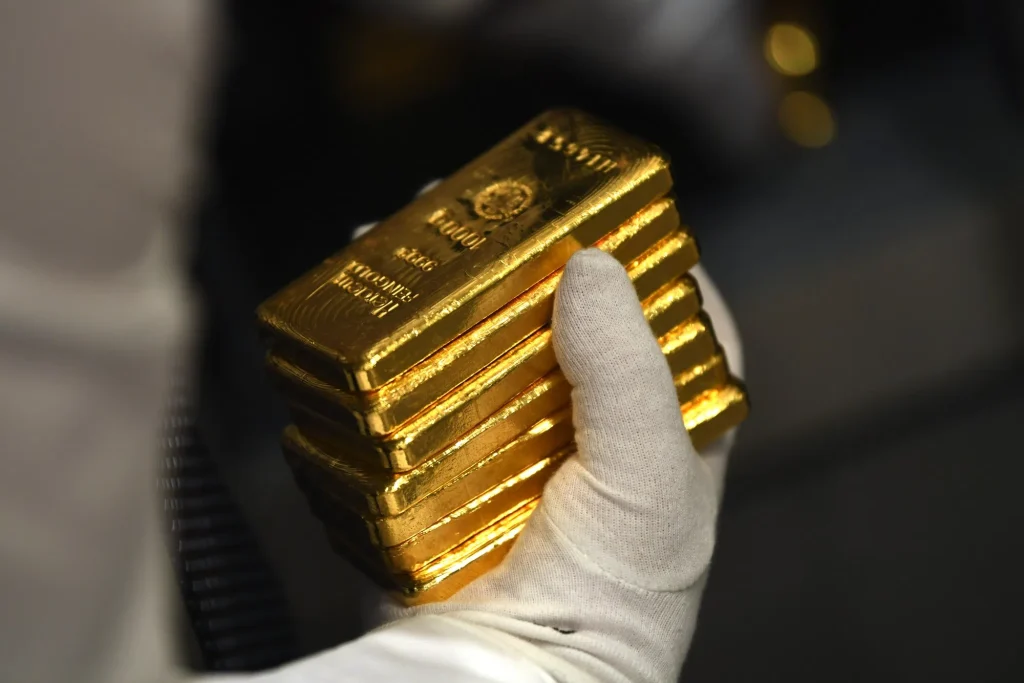

[BENGALURU] Gold prices climbed on Thursday (May 8) after the Federal Reserve warned of rising inflation and labour market risks fuelling economic uncertainty, while investors awaited the US-China trade talks.

Spot gold rose 0.6 per cent to US$3,384.99 an ounce as at 0030 GMT. US gold futures were steady at US$3,392.00.

The Fed held interest rates steady on Wednesday, but said risks of higher inflation and unemployment had risen, further clouding the US economic outlook, as its policymakers grapple with the impact of US President Donald Trump’s tariffs.

Fed chair Jerome Powell said it is not clear if the economy will continue its steady growth or wilt under mounting uncertainty and a possible spike in inflation.

On Wednesday, Trump suggested China initiated the upcoming senior-level trade talks between the two countries and said he was not willing to cut import tariffs on Chinese goods to get Beijing to the negotiating table.

The non-yielding bullion, a safeguard against political and financial turmoils, thrives in a low-interest-rate environment.

On the geopolitical front, India struck Pakistan and Pakistan Kashmir on Wednesday over the tourist killings in Kashmir last month. Pakistan vowed to retaliate and said it shot down five Indian aircraft in the worst clash in more than two decades between the nuclear-armed neighbours.

Spot silver was steady at US$32.46 an ounce, platinum gained 0.5 per cent to US$978.56 and palladium lost 0.7 per cent to US$965.78. REUTERS

Share with us your feedback on BT’s products and services